Woah, this is a default personal text! Edit your profile to change this to what you like!

Solid Member

|

Trump

Aug 19, 2018 8:52:53 GMT -5

Post by kaz on Aug 19, 2018 8:52:53 GMT -5

All illustrate how a society ticks. You want to stick with tax rates, fine. They are part of the quilt. If cutting tax rates for corporations and the rich has less benefit to society than not cutting them, why do it? Tax rates were cut for EVERYONE, not just corporations and the rich. I thought you guys were all about fairness. Here's fairness - pick a number - 10%, 15%, 20%, whatever. EVERYBODY pays the same rate. THAT would be fair. |

|

Woah, this is a default personal text! Edit your profile to change this to what you like!

Deleted

|

Trump

Aug 19, 2018 9:23:05 GMT -5

via mobile

Post by Deleted on Aug 19, 2018 9:23:05 GMT -5

I think the point is that left has no idea what "their fair share" really is. So what is it? The top 1% pay a 90% tax rate? I honestly don't believe the left will ever settle for or be satisfied with anything. Give them what they ask for and it's on to the next notch higher, change the rules, move the goal posts.

|

|

Woah, this is a default personal text! Edit your profile to change this to what you like!

Administrator

|

Trump

Aug 19, 2018 17:31:20 GMT -5

Post by Walter on Aug 19, 2018 17:31:20 GMT -5

Tax rates were cut for EVERYONE, not just corporations and the rich. I thought you guys were all about fairness. Here's fairness - pick a number - 10%, 15%, 20%, whatever. EVERYBODY pays the same rate. THAT would be fair. Clearly you aren't following. I think we've established that fairness is NOT what this is about. Go back and review the eminent domain segment of this discussion. Fair ain't what it's about. This is about maximizing the bang for the buck to get the most societal good. If taxing the top 1% at a 99% rate generated the most good in society and even the top 1% grudgingly went along because they were still making money, so be it. That's the number. If taxing the rich at 1% generates the most good, then 1% it is. |

|

Woah, this is a default personal text! Edit your profile to change this to what you like!

Deleted

|

Trump

Aug 19, 2018 19:17:36 GMT -5

via mobile

Post by Deleted on Aug 19, 2018 19:17:36 GMT -5

Clearly you aren't following. I think we've established that fairness is NOT what this is about. Go back and review the eminent domain segment of this discussion. Fair ain't what it's about. This is about maximizing the bang for the buck to get the most societal good. If taxing the top 1% at a 99% rate generated the most good in society and even the top 1% grudgingly went along because they were still making money, so be it. That's the number. If taxing the rich at 1% generates the most good, then 1% it is. Talk about a squirrelly answer... What is their fair share? Any idea, or just the usual empty ideology? |

|

Woah, this is a default personal text! Edit your profile to change this to what you like!

Now THIS here...is a member

|

Trump

Aug 19, 2018 21:03:16 GMT -5

Post by bgovolfan on Aug 19, 2018 21:03:16 GMT -5

Talk about a squirrelly answer... What is their fair share? Any idea, or just the usual empty ideology? That question has been asked 1000's of times....but NEVER answered Bg(I think it's because they are ashamed to admit that they want it all)VolFan |

|

OK, throw Trump in jail in 2022

Now THIS here...is a member

|

Trump

Aug 20, 2018 18:11:21 GMT -5

via mobile

Post by arkon on Aug 20, 2018 18:11:21 GMT -5

Tax rates were cut for EVERYONE, not just corporations and the rich. I thought you guys were all about fairness. Here's fairness - pick a number - 10%, 15%, 20%, whatever. EVERYBODY pays the same rate. THAT would be fair. Let's go with a 20% rate for EVERYBODY. A family making $40,000 a year would pay $8000. A family making $400,000 would pay $80,000. Sound fair? Look at it this way: The first family is left with $32,000 to get by on. The second family still has a whopping $320,000. 20% is a hell of a lot to a family just barely getting by. Not so fair after all. |

|

|

It isn't enough to love Ohio State. You also have to hate m******n

|

Woah, this is a default personal text! Edit your profile to change this to what you like!

Solid Member

|

Trump

Aug 20, 2018 18:59:31 GMT -5

Post by kaz on Aug 20, 2018 18:59:31 GMT -5

Let's go with a 20% rate for EVERYBODY. A family making $40,000 a year would pay $8000. A family making $400,000 would pay $80,000. Sound fair? Look at it this way: The first family is left with $32,000 to get by on. The second family still has a whopping $320,000. 20% is a hell of a lot to a family just barely getting by. Not so fair after all. You're the one who picked 20%. Too high? Lower it, FOR EVERYBODY, like the President did, to be fair. |

|

Woah, this is a default personal text! Edit your profile to change this to what you like!

Deleted

|

Trump

Aug 20, 2018 20:37:19 GMT -5

Post by Deleted on Aug 20, 2018 20:37:19 GMT -5

You're the one who picked 20%. Too high? Lower it, FOR EVERYBODY, like the President did, to be fair. Kaz, What percentage of all U.S. income is currently "earned" by (paid to) the wealthiest 1 per cent of our population? Any idea? What percentage of the U.S. population (in a recent Federal Reserve report) is currently unable to afford a $400 "emergency" expense? |

|

Woah, this is a default personal text! Edit your profile to change this to what you like!

Godlike Member

|

Trump

Aug 20, 2018 20:51:14 GMT -5

Post by oujour76 on Aug 20, 2018 20:51:14 GMT -5

Let's go with a 20% rate for EVERYBODY. A family making $40,000 a year would pay $8000. A family making $400,000 would pay $80,000. Sound fair? Look at it this way: The first family is left with $32,000 to get by on. The second family still has a whopping $320,000. 20% is a hell of a lot to a family just barely getting by. Not so fair after all. |

|

|

Full Season 2022 Douche Champion

|

Woah, this is a default personal text! Edit your profile to change this to what you like!

Administrator

|

Trump

Aug 20, 2018 21:51:05 GMT -5

via mobile

Post by Walter on Aug 20, 2018 21:51:05 GMT -5

What is your proposal? Are rates supposed to raise revenue for services, or for the government to determine how much you or I need to get by after paying taxes? Short of confiscatory rates or variable pricing on goods, it's impossible to devise a system that is "fair" to all. I keep saying it. Whatever rate(s) generate the best result is the answer. Stop F-ing around with notions of "fairness". Imo, fairness is not relevant. |

|

Woah, this is a default personal text! Edit your profile to change this to what you like!

Deleted

|

Trump

Aug 20, 2018 22:33:13 GMT -5

via mobile

Post by Deleted on Aug 20, 2018 22:33:13 GMT -5

I keep saying it. Whatever rate(s) generate the best result is the answer. Stop F-ing around with notions of "fairness". Imo, fairness is not relevant. You'd bitch no matter what the rate is. It's the liberal way. |

|

Woah, this is a default personal text! Edit your profile to change this to what you like!

Deleted

|

Trump

Aug 20, 2018 22:44:07 GMT -5

Post by Deleted on Aug 20, 2018 22:44:07 GMT -5

What is your proposal? Are rates supposed to raise revenue for services, or for the government to determine how much you or I need to get by after paying taxes? Short of confiscatory rates or variable pricing on goods, it's impossible to devise a system that is "fair" to all.

|

|

Woah, this is a default personal text! Edit your profile to change this to what you like!

Administrator

|

Trump

Aug 20, 2018 22:49:17 GMT -5

via mobile

Post by Walter on Aug 20, 2018 22:49:17 GMT -5

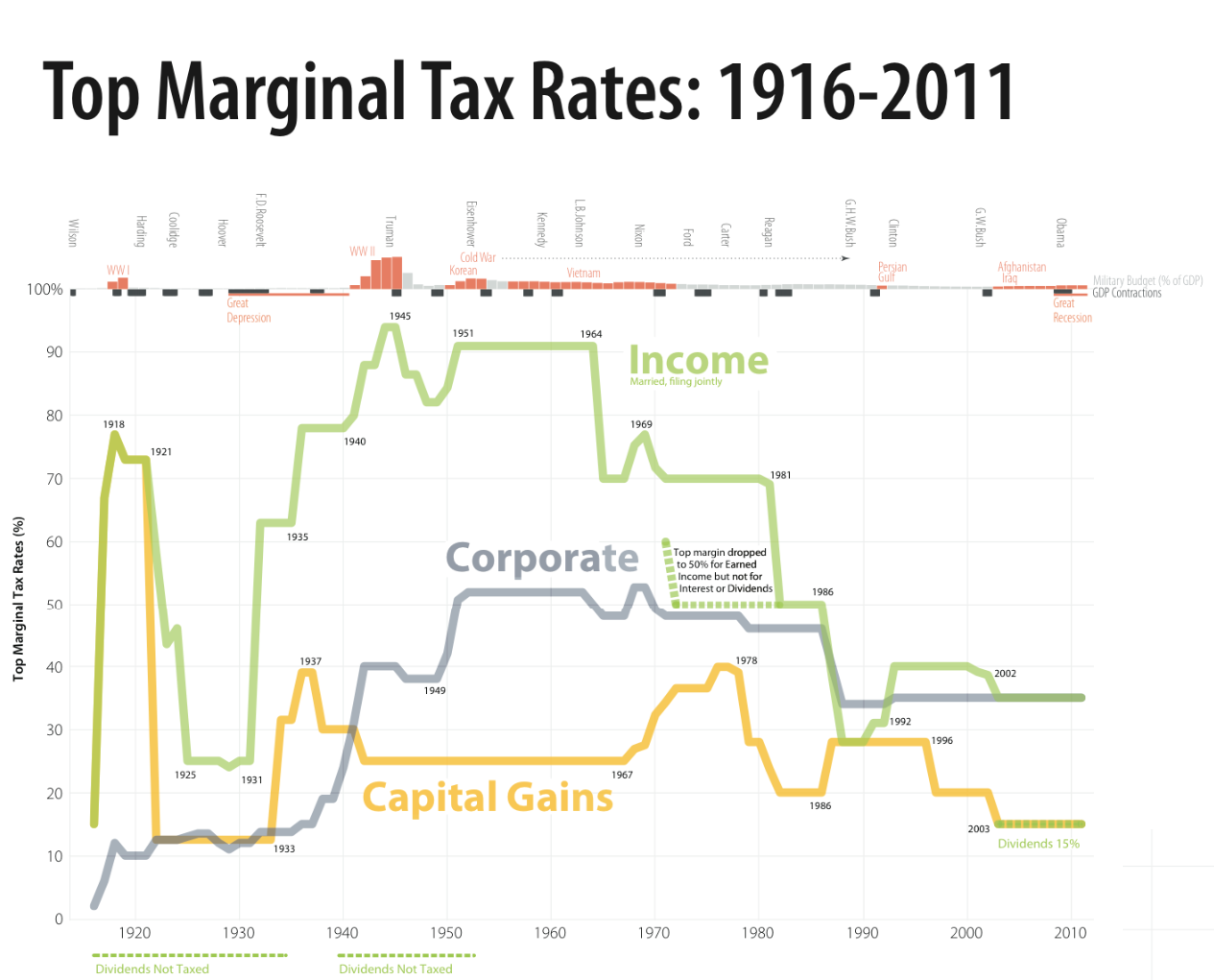

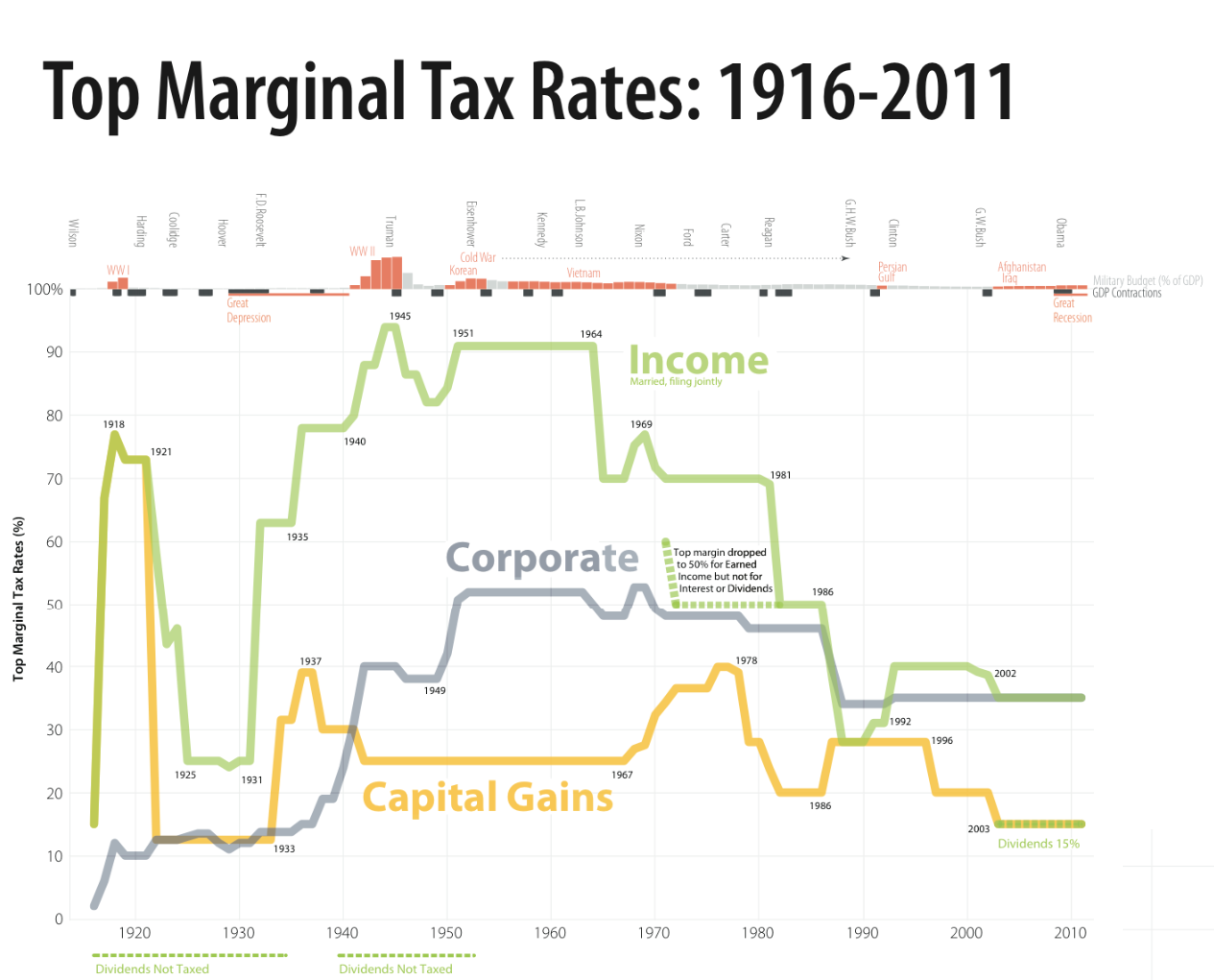

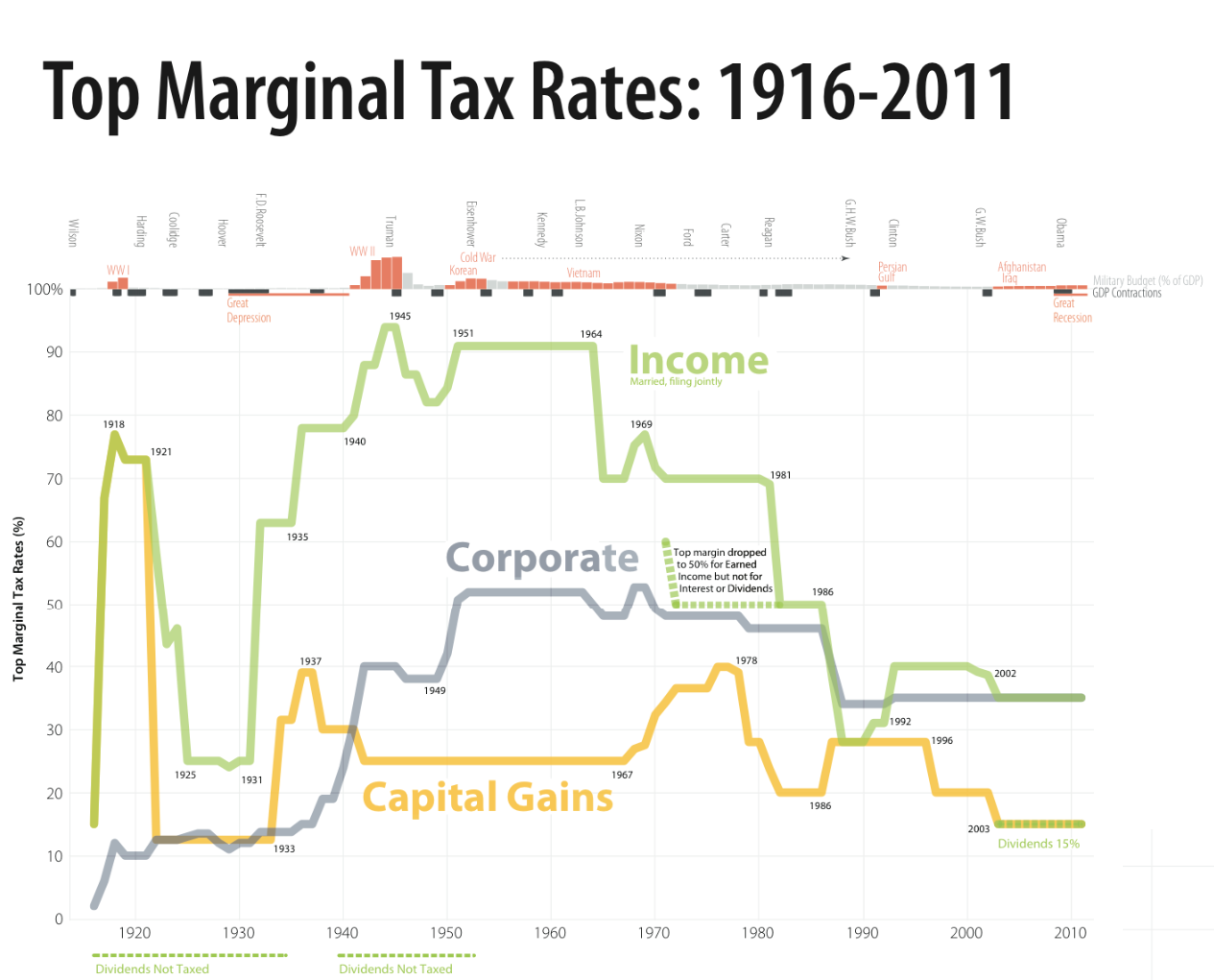

Tax rates for the wealthiest Americans and corporations are at historic 80 year lows (since Pearl Harbor.)Here's documentation for my "claim"-- although this chart doesn't even include the recent further drop in rates under Trump.

Looking at the graph, is it a surprise that we have a deficit? Strange that conservatives do not want to address the debt...or maybe not so strange.. |

|

THE BIGGEST DOUCHE OF THE FULL SEASON TOURNAMENT - 2021

Godlike Member

|

Trump

Aug 21, 2018 0:15:36 GMT -5

Post by daleko on Aug 21, 2018 0:15:36 GMT -5

Looking at the graph, is it a surprise that we have a deficit? Strange that conservatives do not want to address the debt...or maybe not so strange..

Shoot what side of the fence an I on. <shrug> no links.

Willie's graph is missing some important info to make a point, to make his case. Misleading. I believe that the top 1% of American households in the 50s paid an average effective rate of only 17 % in income taxes during the 1950s. 91% down to 17%. and this following the expense of WWII. What's the average effective rate for the top 1% today? 25%?

Assuming my recollections of the differences are accurate. I'll try to dig up some data. If I'm totally wrong, my bad. But the 91% to 17% resonates as close.

That's the problem w relative marginal rates, w/o a whole lot of additional value add information, they can be misleading. |

|

|

THE BIGGEST DOUCHE OF THE FULL SEASON TOURNAMENT - 2021

Bowl Season Champion - 2023

|

OK, throw Trump in jail in 2022

Now THIS here...is a member

|

Trump

Aug 21, 2018 6:18:59 GMT -5

via mobile

Post by arkon on Aug 21, 2018 6:18:59 GMT -5

You're the one who picked 20%. Too high? Lower it, FOR EVERYBODY, like the President did, to be fair. Your idea of fair is grossly unfair. |

|

|

It isn't enough to love Ohio State. You also have to hate m******n

|